Iowa’s governor will develop plan to cut property taxes

May 26th, 2025 by Ric Hanson

(Radio Iowa) – Governor Kim Reynolds says she will meet with Iowans over the next several months and develop a property tax reform plan. In 2023, Reynolds signed a bill into that capped some property tax levies and created new property tax exemptions for veterans and Iowans over the age of 64 who own a home. Reynolds says it’s time to go farther. “I do need to focus on property taxes,” Reynolds said. “That is what we hear about all the time and I was hopeful that the legislature — they had kind of asked to take the lead on that this year, so we let them. I worked on other things.”

Reynolds has until June 14th to sign or veto the bills passed by the 2025 legislature, then she plans to spend the rest of the year working on property tax reform. “I am going to be out in the state and I am going to be talking to Iowans and stakeholders and laying out what it looks like,” Reynolds says. “I mean we have to think differently about how we deliver services to our citizens. We can’t continue to have the level of government that we have and expect the property taxes to go lower. It’s just not feasible. The math doesn’t work.”

Only eight other states have more counties than Iowa. And, according to the U-S Census Bureau, Iowa has more than 18-hundred local units of government, including cities, counties, school districts and townships. During a weekend appearance on Iowa P-B-S, Reynolds did not suggest mergers or consolidations, but she did say every option that would lower property taxes should be considered. “We have to figure out how that system, how we holistically look at the package moving forward and that just, you know, is disruptive…That means people will be a little uncomfortable, but we’ll have the conversation,” Reynolds said.

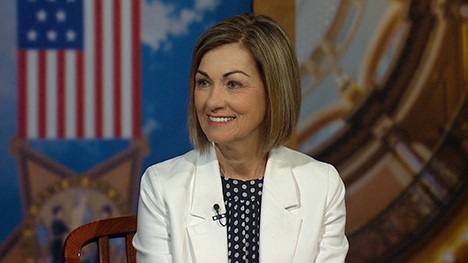

Governor Kim Reynolds is this weekend’s guest on “Iowa Press” on Iowa PBS. (Iowa PBS photo)

“…Forty percent of property taxes is education, so we have a school funding formula that is crazy. It’s so complicated.” One of the main elements of a property tax reform plan key Republican legislators developed over the past two years calls for sending another 400 million dollars in state tax dollars to public school districts, to replace local property taxes. Reynolds appears reluctant to do that. “It’s still taxpayer dollars,” Reynolds said. “I always say it’s local, federal, state — it’s all coming out of the taxpayer’s pocket.”

And the governor says it’s too soon to say a firm limit on how much city and county budgets may grow should be part of the final plan. Reynolds hints an even broader tax discussion could be ahead. “Tax credits, should we maybe reduce some those and plug that into property tax savings or into individual income tax savings?” Reynolds asks. “Sales tax, what do we do with that?” Reynolds has signed a series of tax cuts that have eliminated the tax on retirement income and cut the individual income tax rate to three-point-eight percent.

Reynolds, who announced last month she wouldn’t seek reelection, now says her goal of completely eliminating the state income tax by the time she leaves office would be a little aggressive — and she will engage in a property tax reform debate instead. “I want to create a foundation that when I do leave, the next Republican governor that sits in that chair will be able to continue to reduce the individual income tax rate,” Reynolds said.