KJAN News can be heard at five minutes after every hour right after Fox News 24 hours a day!

Keep up-to-date with Fox News Radio, Radio Iowa, Brownfield & the Iowa Agribusiness Networks!

KJAN News can be heard at five minutes after every hour right after Fox News 24 hours a day!

Keep up-to-date with Fox News Radio, Radio Iowa, Brownfield & the Iowa Agribusiness Networks!

(Radio Iowa) – House Speaker Pat Grassley says the agreement Republicans have reached to dramatically cut the personal income tax rate to just under four percent by 2026 includes a backstop if the economy dips. If state tax collections fall below expectations, money in the state’s Taxpayer Relief Fund would be used to fill state budget holes. “If there’s a revenue shortfall…it will make up the difference just through the mechanism that’s in place,” Grassley says.

The Taxpayer Relief Fund is expected to have two billion dollars in reserve by July. Withdrawals would happen if state tax revenue growth falls below three-and-a-half percent. Grassley says the state’s financial ledger shows tax cuts won’t lead to budget woes. “We have a billion dollar surplus. We have a billion in the Taxpayer Relief Fund. Our ‘rainy day’ and cash reserves are full at over $800 million,” Grassley says. Republican lawmakers passed tax cut packages in 2018 and 2021.

Grassley says taking an initial vote on the House G-O-P’s 2022 version eight days ago has provided momentum to this year’s tax cutting effort. “Before the session we said we were going to provide real tax relief for Iowans, we have an overcollection of their money and we’re going to get it back in their hands as quickly as possible,” Grassley says. “I think we’re showing that doing that in February, we were serious about it and we’ve followed through on those commitments.”

The plan Republicans intend to vote upon today (Thursday) includes a corporate income tax rate reduction, but it’s not automatic. If total corporate income tax payments exceed 700 million dollars, the corporate tax rate would be ratcheted down. “The mechanism that we’re going to work off of is the governor’s and I think it’s a very responsible plan,” Grassley says. “It make sure it maintains the state at $700 million worth of revenue, so you’re not going to see any drastic dips when it comes to revenue. You maintain that level and the growth over $700 million works to lower the rate.”

The governor’s proposal, unveiled in January, ultimately seeks to reduce the corporate income tax rate to five-and-a-half percent. The bill also reduces several refundable business tax credits by 25 percent over the next five years, plus the state’s research activities tax credit — the most generous in the country — would be cut in half during that time frame.

“From the House’s perspective, we feel very confident,” Graslsey says. “Not only are we right there where we wanted to be on the income and retirement pieces, we’ve also taken the holistic approach to looking at that corporate piece that we felt very strongly about.” The plan erases state taxes on retirement income. It also includes a tax break for retired farmers. The Senate is scheduled to debate the tax plan first, but the debate had not yet started by mid-afternoon.

(Radio Iowa) – Iowa Senator Joni Ernst says the situation in Ukraine is weighing very heavily on her heart after Russia attacked there today (Thursday). “We need to provide a unified front, and push back heavily,” Ernst says.”The repercussions should be very stiff economic sanctions, against Vladimir Putin, his cronies, and most of all, himself.”

Ernst hopes congress will be united in acting to support measures against Vladimir Putin and Russia to put pressure on them.

“What we’ve got to do is make sure that those who are out there touting green energy and shame on America for being such a big energy producer — they’ve got to get out of the way — we’ve got to ramp up energy production here in the United States. That’s how we ramp up pressure on Russia at this critical moment,” according to Ernst. The Red Oak Republican says that pressure does not involve direct military involvement, but our troops may play a background role. Ernst says military alliances come into play if Russia goes beyond Ukraine into other countries that are part of NATO.

“If Russia goes into a NATO country, an armed insurgency in another NATO ally, it does trigger Article Five and it does mean that the United States would respond,” Ernst says. Ernst says it is important to respond to provide assistance with Ukrainian refugees that will be pouring into other countries.

(Radio Iowa) – A high-speed chase Wednesday afternoon through Webster and into Calhoun County ended in a cornfield with an arrest and a car in flames. Iowa State Patrol Trooper Paul Gardner says it started when Archester Rodgers of Minnesota was clocked driving at 95 miles-an-hour on Highway 20 east. “The traffic stop was attempted and the driver made a U-turn to proceed back westbound on highway 20. At that point the chase was on,” Gardner says. “A trooper at one time used a pit maneuver to end the pursuit that directed the vehicle into the ditch.” Gardner says it wasn’t the end of Rodgers’ attempt to get away.

“He was still somewhat mobile, but then when he tried to drive through a cornfield, that’s when his car started on fire and became fully engulfed,” he says. Trooper Gardner says Rodgers is being held in the Webster County jail on active warrants out of Minnesota. He did not have an active driver’s license, and was charged with

eluding, possession of a controlled substance and some traffic charges related to the pursuit. No one was hurt during the pursuit.

DES MOINES – Iowa Secretary of State Paul Pate has announced the formation a new 11-member, bipartisan Auditors Advisory Group to assist in administration of the 2022 elections. The auditors represent urban and rural counties, offering unique perspectives from various areas of the state, and include three from southwest Iowa.

The members of Secretary Pate’s Auditors Advisory Group and the county they represent include:

Amanda Harlan-Monroe

Amanda Waske-Ringgold

Carol Robertson-Mills

Jamie Fitzgerald-Polk

Jennifer Garms-Clayton

Karla Weiss-Winnebago

Melissa Wellhausen-Page

Rhonda Deters-Grundy

Ryan Dokter-Sioux

Sue Lloyd-Buena Vista

Whitney Hein-Jones

Secretary Pate said “Overseeing elections in Iowa requires a team effort from all 99 counties, and these 11 auditors are recognized by their peers as leaders who will help ensure clean, smooth elections across the state. I value their insight and will listen to their input. Together, we will share ideas and best practices for the upcoming primary and general elections.”

(Radio Iowa) – A Montana man has pleaded guilty to scamming a Cedar Rapids derecho victim out of thousands of dollars. Fifty-seven-year-old William Hurlbut Junior of Belgrade, Montana pleaded guilty to one count of mail fraud and admitted he posed as a contractor following the August derecho in 2020. He promised a disabled Cedar Rapids man he would fix his derecho-damaged home and took a 10-thousand dollar prepayment.

Hurlbut also admitted to taking supplies he said were for the work and got refunds. and sold the man’s car without permission. He spent the money on gambling and personal items — and never did any work on the man’s house. He is awaiting a sentencing date.

(Radio Iowa) – Tax negotiations among key Republicans at the Iowa Capitol appear to have yielded a final plan. Senate Majority Leader Jack Whitver spoke with Radio Iowa after meeting with his fellow Republicans in the senate early this (Thursday) morning. “This is going to be a historic day here in the Iowa Senate and in Iowa in general,” Whitver told Radio Iowa. “We’re about to pass the largest tax cut in state history. Happy to get agreement with the governor and the House to get this done and deliver on a promise that we made for the past year, that when we have excess revenues, we’re going to continue to cut taxes.”

Whitver said the final version that will be making its way through the legislature today hews closely to the plan Republican Governor Kim Reynolds unveiled on January 11. It shrinks Iowa’s personal income tax rate to a single rate within four years. “We’re going to be at 3.9%, which of the states that have an income tax will be the fourth lowest in the entire nation,” Whitver told Radio Iowa. “That’s a huge improvement from the eighth worst, which is where we started.” The plan will erase the income tax on retirement income and it will reduce the corporate income tax. The final deal also reduces a handful of refundable tax credits, including the research activities tax credit that yields refund checks for some corporations.

“It’s kind of a compromise between what the governor laid out day one and what the House and the Senate have been working on,” Whitver said. “so we’re going to continue to, over time, ratchet down the corporate rate as the governor laid out, but as the Senate and the House we wanted to continue to look at some of the tax credits and how big the checks are that we’re writing out to some of the biggest entities in the state of Iowa, so we’re going to start to ratchet down the refundability of those over the next five years and try to make the (corporate income tax) rate flatter and fairer for everybody, instead of just special interest carve outs.” Whitver says the plan does not eliminate tax credits, but in some cases will reduce a corporation’s ability to use the credit to eliminate it’s entire tax liability and wind up getting a refund check from the state.

“Starting that conversation of what we need our tax code to look like long term,” Whitver says. Last year, the state issued 44 million dollars in tax refund checks to a small group of corporations that claimed the state’s research activities tax credit. Last June, the governor signed a bill that cut personal income taxes, eliminated the inheritance tax and got rid of a property tax levy. Senate Republicans estimated it would reduce state tax collections by one billion dollars over eight years. Early estimated indicate the plan to be voted upon today be far larger.

“This has been a Senate Republican priority for the six years we’ve been in the majority, to continue to reform taxes and make us competitive,” Whitver said. “When we pass this bill today and hopefully the House does the same, Iowa will be one of the most competitive states in the country now for taxes.” On Tuesday night, Governor Kim Reynolds is scheduled to deliver the Republican response to President Biden’s State of the Union speech. Action today (Thursday) on the tax plan means she’d be able to mention it in her remarks. “Iowa has a great story over the last couple of years and we’re really excited that the governor gets to go on a national stage and explain that story and this is just part of it,” Whitver says, “but it certainly is a big part of it.”

(Glenwood, Iowa) – Sheriff’s officials in Mills County said Thursday (today), one person suffered unknown/possible injuries during a single-vehicle accident that occurred at around 2:36-a.m., Saturday. Authorities report 67-year-old Roger Allen Klabunde, of Pacific Junction, was traveling south on 195th Avenue in a 2016 Kia, and attempting to turn onto Eastman Avenue. For reasons unknown, Klabunde turned the steering wheel too soon, causing the vehicle to enter the east ditch, where it hit a tree.

Rescue personnel transported Klabunde to Mercy Medical Center for evaluation.

(Glenwood, Iowa) – The Mills County Sheriff’s Office is reporting numerous arrests from Feb. 9th through the 22nd. Five people were arrested on separate warrants for Violation of Probation, including: Tera Lee McAtee, of Glenwood; 32-year-old Kassandra Lee Shoemake, Monta Arnell Johnson, Jr., Shanna Marie Black, and Sheena Marie Griffin, all of Omaha.

Authorities say 24-year-old Jacob Lee Reafleng, of Red Oak, was arrested Feb. 14th, on a warrant for Failure to Appear on drug charges, and 46-year-old Brent William Michael, of Malvern, was arrested for Possession of a Controlled Substance, Poss. of Drug Paraphernalia, and Driving Under Suspension.

31-year-old Ryan Jarrett Wright, of Glenwood, was arrested Feb. 11th for OWI/1st offense. 24-year-old Taylor Marie Otis Wright, of Council Bluffs, was arrested Feb. 17th for Driving While Revoked or Denied. And, 30-year-old Shialea Kay Cozad, of Omaha, was arrested Feb. 22nd, for Driving While Barred.

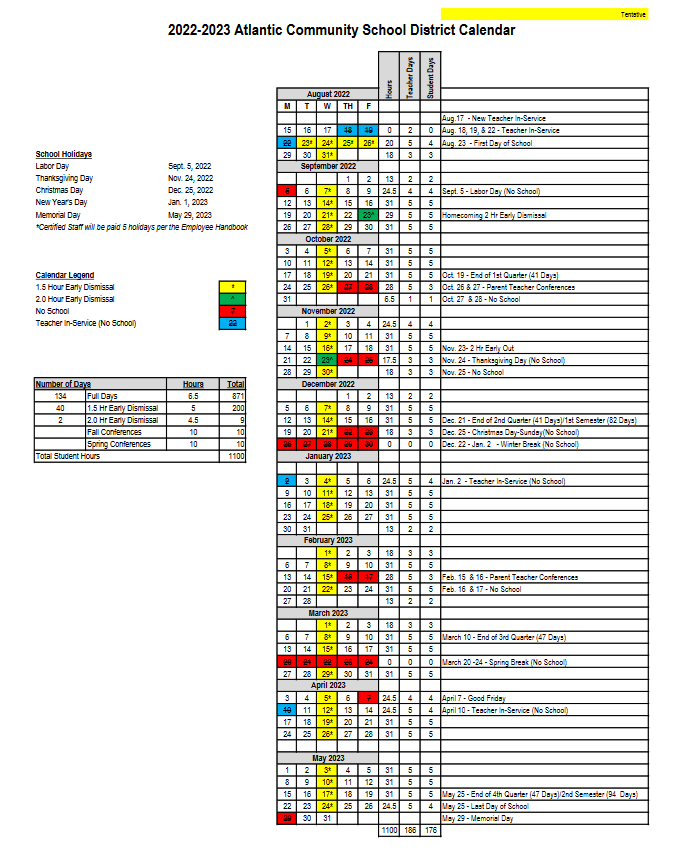

(Atlantic, Iowa) – Members of the Atlantic School District’s Board of Education met Wednesday evening at the Schuler Elementary School. The Board received updates and discussed matters pertaining to “Positive Team Culture,” and the Instructional Framework. Superintendent Steve Barber reminded the Board a Public Hearing on the 2022-23 School Calendar will be held 5:30-p.m. March 16th. (See the tentative calendar posted below)

In addition to the school calendar hearing, March 16th at 5:30-p.m., is also the date/time for a Public Hearing on the High School South Parking Lot Project. The Atlantic School Board moved discussion with regard to the 2022-23 Certified Budget Review from March 23 to the 16th, also, due to schedule conflicts. Spring Break in Atlantic takes place from March 21st through the 25th.

The Board, Wednesday, approved a Progress Invoice Request with regard to the Atlantic Middle School Fire restoration project. Superintendent Steve Barber said the District still has not received a check from EMC Insurance but is working hard to make that happen. The Board approved an amount of slightly more than $1.7-million to First Onsight, the disaster recovery and property restoration company, once the check is received.

Barber said there are several sub-contractors still waiting to be paid, and it’s hoped that the check will come by March 16th.In other business, the Board approved a pay application in the amount of $13,089 for the Middle School & Schuler HVAC/Aur Quality Project. The payment will come out of the ESSER funds the District has received. They also approved a bid from Camblin Mechanical in the amount of $132,135, to replace seven HVAC units. This will complete the cycle started a number of years back, and means all original units from 1995 will have been replaced at the completion of the project.

The Board’s final order of business was to approve extra options for the 77 passenger bus they approved last month, the base bid for which was $122,319.

With those added components (Luggage storage and air conditioning), the grand total comes to $135, 719. Mr. Barber said the bus was ordered after last month’s Board decision, but has not yet been built. That process will take several months.

(Atlantic, Iowa) – Rescue crews from Marne and Atlantic were dispatched to the scene of a rollover accident late Wednesday night. According to scanner traffic, a 2020 Chevy Traverse rolled over near 590th and Marne Road. The accident happened a little after 11-p.m. The female driver and sole occupant of the vehicle was injured and extricated from the vehicle. She was transported to the Cass County Hospital and then flown by LifeNet3 helicopter to an undisclosed hospital.

Additional details are currently not available.